Eventually, I started making a bit more money and had a little financial wiggle room. I started to engage in decadent things like full-priced movie tickets, non-pre-owned clothing, and living by myself. $30 sundresses from Target! The luxury!And then I started to make even a little bit more money. And I could drink $12 cocktails, like, once a week.

Every once in a while I’d spend more than $30 on a piece of clothing. I HAVE ARRIVED! I AM FANCY NOW!But the funny thing was, even though I was making more money – I was saving the same amount.I fell into the trap of spending money because I “could.”

“Grown-ups with real incomes go out to eat a lot. Maybe I’ll do that now?”

“I can afford Aveda shampoo and I want to smell like fancy dirt. I’m going to spend $12 on that bottle.”

“It seems like expensive haircuts are better. Are they better? That salon is full of cute girls. I’m sure I’ll be cuter if I pay them $60 to cut my hair.”

But when I really thought about it, those $15 an entree meals and $12 shampoo and $60 haircuts weren’t particularly awesome. Or rather, they didn’t make me happy or make my life easier, the way that some other purchases did.

I decided to actively notice which purchases that made me happiest.

I realized that:

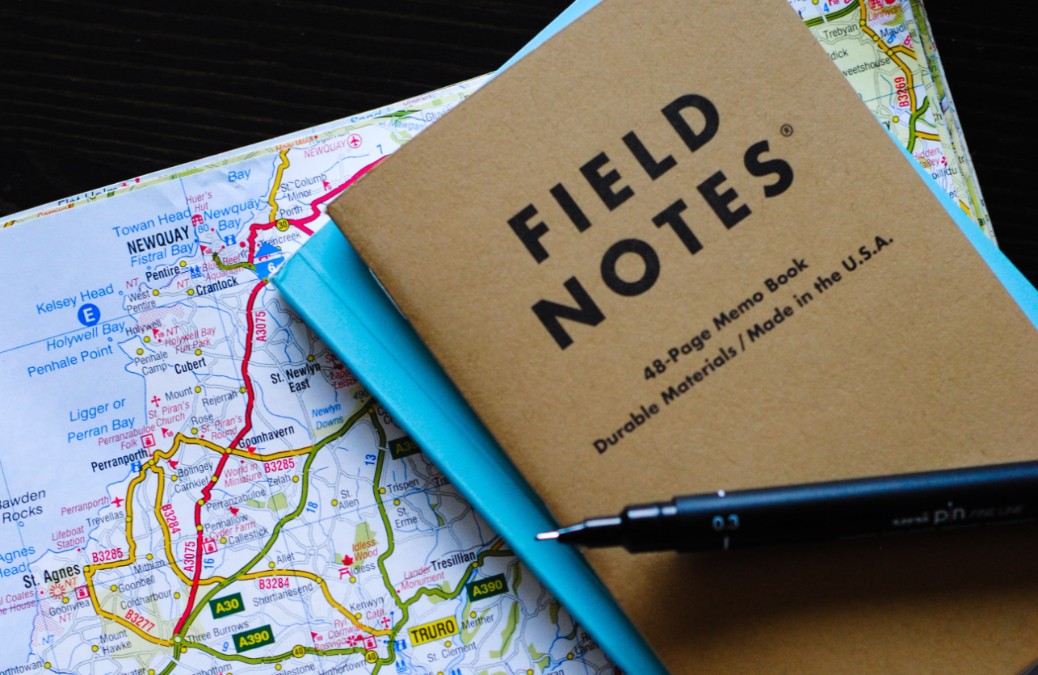

Travel made me happy.

Mid-day pedicures with my girlfriends made me happy.

Perfectly ripe produce and amazing cheese made me happy.

Funny art prints and colorful throw pillows made me happy.

These earrings made me happy.

Name brand clothing, manicures, expensive meals, non-costume jewelry, cable, $4 coffees did not make me happy.

These things are really great and totally happy-i-fying for some people! It just so happened that – when I really thought about it, I realized – they did nothing for me.

So I stopped spending money on things because I “could” or because I thought that’s what “adults who work hard for their money” do.

I started putting my money where my happy was.

And you know what? Now I’m happier and my savings account is too.

Figure out what brings you joy and then buy it. Skimp on the other stuff. It's that simple! Share on XHow do you budget for the things you love? Do you ever find yourself spending more money when you’re earning more?

P.S. How to (at least start to) get your finances under control + How to pay off your soul-crushing debt

Love this post. When I grow up (I.e. graduate) I want to put my money where my happy is! I love traveling as well, so I love the idea of saving for that. Even with my small student budget, I find myself spending a majority if my monies on local organic produce. A teacher if mine once made the observation that we're more willing to spend money on what goes "on" us (clothing, car, etc) than what goes in us. I'll thrift shop all day long so I can have fresh healthy food!

Yes I do!

I used to be on half what I'm earning now and am I saving more? Noooo.

I guess I did move out of my Mum's house, and so I have more bills to pay – but I do spend money on the silliest things "because I can."

Amber

fancy dirt, hahaha 🙂

I JUST WANT TO SMELL LIKE AVEDA WITHOUT SPENDING AVEDA MONEY!

I have a Travel savings account, into which I automatically deposit a certain amount each week. Travel and experiences in general (massages, concerts, tours, museums) are the things that make me happy. And I have a different problem: I save OBSESSIVELY to the point where I feel guilty if I spend money on something fun. I still get my DVDs, museum passes and books from the library, still buy a lot of clothes at thrift shops and feel guilty anytime I splurge on a favorite makeup item.

I hear you, girl. For the longest time (even now sometimes) I was the same way. It took me three months to buy those earrings I linked to up there! Now I remember that I work so hard (so hard!) so yes, self, you're allowed those $25 earrings you've been obsessing over for 90 days.

Yeah, I suppose if you're obsessing for 3 months straight, it's all good 😉 And the flip side is that… I have all this money sitting in my savings account for an emergency or rainy day and what if I just DIE tomorrow?!! Or what if I don't have an emergency or rainy day and I could have just gone on massive retail therapy shopping sprees? 🙂

This is a much needed post because I've recently put myself on a "spending ban". No more clothes, fancy candles, or books. (It's time for me to support my local library!) I recently spent 4 months in Spain and it has taken its toll on my savings. I'm going to then think about where my "happy" is and when I'm off the ban, spend my money carefully.

Thanks for the money reminder!

I make a pretty competitive salary for a 23-year-old, so it was easy to start thinking I had all this extra money. But I also have all these extra expenses, like insurance, utilities, internet, etc. So I overspent a little at first, but then I realized what you did: it didn't really make me happy.

What does make me happy? Food. Cooking. Baking. Bringing homemade treats to friends' houses, bible study, church events, work. Running. Books. Volunteering at the animal shelter. So I spend my money on food (I never tell myself no at the grocerty store), books I know I'll read, running shoes and gear, and the occasional flannel to beef up my volunteering wardrobe.

A budget tip: being vegan means you can't eat at 80% of the restaurants your friends go to (unless it's like a salad and like hell am I paying $15 for a bowl of iceberg lettuce and three cherry tomatoes), so I save a ton of money by just getting a fancy beverage and enjoying the chatter time without a meal! That and meat is expensive, so I save gallons of money buying flats of black beans at CostCo (6 cans for $4.19!) instead.

So smart! I'm also a huge fan of getting a beverage + app or steering my friends towards cheap Asian places or Indian places 🙂

I've lived at home with my parents for the past 2 1/2 years, and I've managed to save a considerable amount of money for someone who makes very little of it. But now that I'm ready to move out soon (and now that I'm looking at my spending habits a little closer), I realize I could've saved much more if I didn't indulge so much in clothes. I mean, hey, I like pretty things. But the mindset of "I deserve this pretty thing!" every single time I see a pretty thing isn't the smartest approach. Pretty soon I'll be putting away/selling the majority of my winter wardrobe, and the only clothes I'm allowed to buy are thrift store clothes until further notice. Luckily, I've fallen out of the habit of clothes shopping anyway, because I'm sick of all things winter.

I was so broke for so long that I totally struggled with giving myself the permission to spend money on the things I want-in fact I still do! I spent an inordinate amount of time last night deciding whether or not to pick up relatively inexpensive thai food for dinner. Update: I bought the thai food and it was incredible.

I'm working on it though and I'm getting better. There are three things that I generally "splurge" on: quality walking shoes (I live in an urban area and don't drive: keeping my feet happy is essential!), non-costume jewelry, and professional clothing. I work in an office so I spend a lot of my time in professional clothing. Spending the money of jewelry and clothing that don't fall apart after three wears has been so worthwhile to me. PS: nice clothes and jewelry retain a lot of their value if you take care of them. In a pinch, or even just when you're bored with something, you can resell it! Cheap clothing and costume jewelry are so wasteful. Sure-it's fun to be able to buy ten cute tops at a time, but those tops will be ruined within a few washes and then end up in a landfill!

I'm a performing artist who takes on theatre/teaching gigs to make ends meet, so this year I've struggled with the question of need versus want. If I'm buying groceries for the week, then yes, bananas will do just as well as any other fruit, but sometimes I'll buy a few overpriced apples because their simple joy is worth it; money can be saved in other places in the grocery store. One way I've found to combat expenses and still do something meaningful is to bake with friends because not only do I get to cook and have conversation, but also it's cheaper than going to a restaurant or a movie where there might be more distractions.

Do you have any suggestions, though, for budgeting "fun money" in when you have no standard monthly income?

Oh, it's tough when you don't have a standard income. Here are my general budgeting/cheap life tips: https://www.yesandyes.org/2009/06/rocking-champagne-life-on-beer-budget.html

I've gotten better about thinking of my goals before making impulse purchases, i.e. I could just spend $10 on a book (used even!)…Or put that albeit small amount toward my new bed fund. I do buy aveda shampoo though. Trying to be more eco-conscious can be spendy

Valarie, do you have a Whole Foods or Co-op nearby? They usually have eco-conscious shampoo (and body products) for much less than Aveda and sometimes you can even buy them in bulk and bring your own bottles!

There is one near Lake Calhoun, I will have to chdck out the shampoo section! Anyway it will be an excuse to bike there 🙂

This is such a prescient post, because I just recently (as of April 1st) stopped getting my favorite $4 drink from Starbucks every morning. Though I did love the drink, I also realized it was kind of just a habit, a regular routine, for me and that brewing a cup of coffee in my own home or at the office would work just as well. (I know it sounds obvious, but it hadn't been to me.) So I've given up the $4 drink – at least for this month! – to see if I can break the habit. The money-saving key, though, is not immediately spending that daily $4. Each morning, I've transferred $4 into my savings account, so I can actually see the money I've saved over a month. I look forward to being able to spend that money on things that truly make me happy!

So, so smart! And I think a lot of us fall into this. At the beginning, the $4 coffee really is a 'special treat' that adds something to our day, but the more often we buy it, the less special it becomes, and the less happy it makes us 🙂

Also: I got my car valeted (FOR THE FIRST TIME IN MY ENTIRE LIFE) at a show last night and it made me so happy. It cost $2 more than parking in a ramp a quarter mile away.

Also: I felt like a total baller.

Slightly undermined by the fact that I drive a 2003 Ford Focus but whatever. 😉

To quote a certain awesome blog… "YES AND YES!"

I started doing this a year ago out of necessity (medical bills plus a house to maintain on my own post-divorce). As of today I am debt-free, with the exception of my mortgage. It has been a gradual process, changing one thing at a time, but I had to choose what mattered more. I don't miss a single thing I've given up, because that way I'm able to have what I really want. I write about it on my tiny corner of the Internet: http://www.wealthnotmoney.blogspot.com.

Thanks for another great and insightful post, Sarah!

This is truly amazing advice – simple but it takes a bit of honset self-reflection to really get to the bottom of where your money goes + what actually makes you happy. Trusting + listening to yourself is the hardest part I think!

Considering I live below the poverty line, I definitely do not spend more than I make! I budget for traveling + food: those are my happy, and anything that is not related to either of those has to be too-good-to-pass-up status. Clothes will typically win out, but again, it has to be something I just can't stop thinking about before I plunge in, money first.

Items I cut out of my spending: collecting, conventions, make up, and 90% of the time I do not buy drinks while out. I'd rather put my money toward good food and drink water.

If there is a big item I want, I use my piggy bank! For example, I am currently saving up for the big purchase of the Gilmore Girls DVD collection. I love that show, I will always sit down and watch it no matter what else is on. High time I just owned it. Instead of dipping into my savings for instant gratification, however, I've been putting all of my spare change into my Muppets bank and saving up over time. I actually need to do a coin check on that, but I think I am somewhere near the half-way point. It will be far more rewarding to buy this when I've saved up enough over time. I think being a grown up sometimes we forget the satisfaction of waiting 🙂

You are so, so right. It feels really good to 'earn' something, regardless of whether you can afford it or not. I know that I have enough money in my checking account to get a new pair of boots, like, today.

But I'd rather research which pair to get, go try a bunch on, and then tie the purchase to a specific achievement – pitching five magazines, landing three new clients, etc.

I recently found your blog, Sarah and love it! Some of our neighbors came by the other day and asked us how we afford to travel, and I told them to come on in! We've been living in our house for more than three years and it still looks like a fraternity house. I think they understood after the house tour that our house is just one of the many areas we go without so can go on our next trip. We just focus on what brings us happiness! But sometimes it is hard, so thanks for the reminder to keep on keeping-on!

Interesting idea… maybe I should think more about it.

I have the opposite habit: saving like I'm going broke. It's real nice to feel comfortable financially (to the point where yesterday I found a two month old paycheque in my bag – oops!). But I feel kind of dumb about still only owning enough clothing for a week and being the only person left on the planet without a smartphone.

Baby steps.

I love this! I'm so bad about being like "it's pay day, gotta go to the mall!" But when I skip the mall for something productive, I feel better, and so does my savings. I am so quick to justify luxurious purchase (literally just purchased Justin Timberlake concert tickets 1200 miles away from where I live because HELLO, it's during my birthday week. Don't I totally need that??!). I love the idea of being choosy with what you splurge on – I need to work on this!

ah, yes, this is so relevant to me right now! my fella and i are apartment searching in brooklyn, ny (a no good, very bad experience no matter what) and were trying to get by without a broker's fee for a while, thus making our selection pretty dismal. however, i realized that it is really important to me to have a decent – by no means extravagant – home in a safe neighborhood, where i can walk to a farmer's market, a library, restaurants, etc. it's worth not going out for a while and eating beans and rice for lunch every day (but i do make some delicious beans and rice) to save up for a broker's fee and have a comfortable place to call home.

I make fortnightly 'savings' a compulsory thing, like paying bills. Money has to go into my savings account just like I have to pay my phone bill or rent – and I don't even notice it!

I also allow myself the same spending money each week and withdraw it in cash. For some reason I'm way more reluctant to hand over physical cash than I am just to swipe my card. 🙂

Truth! When I'm on a budget, I take out my 'allowance' in cash and once I spend that for the week? It's soup and hulu 😉

The last few years have been full of huge money learning lessons for myself. My husband looks at money in some very different ways than I do. We are both fairly conservative but we just had different habits. It's been very interesting in adopting a few of his here and there. Changing my ways in very subtle ways has resulted in a very different end destination.

For example, I don't spend to the max of what I budgeted for something. If my extra money was $20 for say a splurge treat I used to spend that $20 every single time I had it. Now I give a bit more thought to if I really want it, if I really need it and because I'm first and foremost meeting my more basic needs like Food/Housing/Bills/Savings I find I'm less likely to spend to the end of that $20. And just not spending to the end of that budget means that money either builds up and goes into savings or I have the opportunity to buy something extra special.

I feel like my thoughts are the source for your content. Just yesterday I did a big evaluation of my budget. I realized that I was spending a lot of money on coffee and iTunes. Neither of which make me happy. In order to get a feel for what I actually need/want I decided not to buy these things for the month of April. I want to see if I notice the different. Thanks for this pertinent post!

Oh but it made me SO happy when I actually could spend some. Like go to H&M and buy whatever I like. Hah. Missed teenage dreams needed to be lived. However, some things haven't really changed – I still hunt at sales and go for second hand shopping (which I love, but which is hard in Madrid 'cos it's not popular here). I also try to save up more now. But the initial instinct to spend was quite big. Also, I don't spend on fancy dinners and stuff. I don't think they would make me happier than some less fancy, but delicious food. But all in all it is true – income and savings aren't really in correlation like one would hope.

This post is great – and very timely for me having just returned from an amazing trip in Canada, which cost a considerable amount

I've always been a bit of a saver, and don't like spending out on anything I see as unnecessary, but it's easy to fall into lazy habits

So not buying takeaway coffees when I can make them at work, and not paying £3 to park my car when I could just cycle for free might seem like small savings – but they soon add up over a week, month and year!

Especially when you add in that dress I'm only going to wear once, or the gym membership I'm never going to use

All much better spent on travel and spending fun times with friends

Love your blog

LOVE this post! Travel is such a worthy investment!!!!

I'm a huge believer in this philosophy and it can be applied to virtually everything.

You have to sleep: so create a sleeping space that makes YOU relaxed and cozy

You have to eat: so eat food that makes YOU feel great

You have to exercise: so pick a workout that YOU think is fun

You have to work….so find a job that has aspects that make YOU engaged

I heartily apply this to food, especially. Before I eat something unhealthy, I try to ask myself if it's worth the calories to me. That makes it easy to skip cheesecake (which I think is just pretty good) and eat burgers (which make me salivate).

I LOVE beautiful clothes, but I will easily walk away from anything that I don't feel is perfect. After two years of doing that…my closet is literally full of things that I smile when I wear, and I do less shopping overall, because I'm so happy with my existing wardrobe.

It's hard to apply this principle to work, because everything moves slower and you have to pay bills, and there's less instant gratification…but I'm working on that one!

Such a great philosophy!

I agree with everything you said, and wrote a similar post myself a while ago… I chose to change careers and decrease my salary by a LOT in order to do what makes me happy. It has taken some huge adjustments to get out of the habit of buying whatever I want, when I want, but it's worth it. It actually makes me cringe to think of how much money I spent when I could have been saving all those years!

Sarah, you are SO my kinda girl!

xo

This is really relevant for me – I've been debating on whether I should sign up for some semi-pricey organic gardening classes at a community plot near my house. I've been telling myself that I can cut back on clothes and things, which don't make that big a difference to my overall happiness beyond the novelty of getting something new in the mail or wearing it for the first time, and splash out for a new skill I've been wanting to learn for a while!

Wow! Love this post. As someone who is just starting to keep a budget (7 months after starting work, and thinking to myself, why don't I have more saved?) this is great. I love the idea of thinking about money and where to spend it in this way.

I really admire this! I was raised in an environment where spending money on expensive and fancy things was just how it's supposed to go, and when I tried, I wasn't all that happy. I found the smaller things that made me happy were what I preferred. So I have tried to do that. I love websites, so at one point I had close to 15 or so domains. But having that made me happier than having cable TV and/or other things, like the money to go out and spend money on the weekends with friends (plus I'm an introvert).

I never really thought about how putting money where my happy is is better in a way. Maybe I'll start spending mine differently now?

I have a little more cash now than I used to, and I still struggle with this. I am going to take your advice and become more aware of my purchases. Thanks for the great post!

Thanks a lot for this post, it inspires me. I think I have some money issues, always want to spend it on superficial things. I have to work on it…

Does using the library for DVDs and books mean you’re broke? Huh. I always thought it meant you’re financially savvy and resource conscious. 🙂

i enjoyed reading your article, Some good info here, thanks.

Love it! I’m just finding this post now. “Put your money where your happy is!!”. So often personal finance advice demonizes all non-essential spending. I love your point that there’s nothing wrong with a $12 cocktail if it makes you happy. It’s the spending that we can’t afford and also doesn’t make us happy that we need to work to avoid. Love it! #TipYourself #YouEarnedit

I really like this – put your money where your happy is! So simple but it makes such a positive difference in everyday life (I know because I started doing this too!).

Mmm, cheese! And Trader Joe’s has this amazingly delicious white cheese that’s soaked in red wine. It’d to die for and one thing I’ll blow a few bucks on now and again.

I definitely agree! I have been dirt poor before – mostly due to spending all my money on trips and such, but never regretted it. I jumped back and saved loads of money. I so agree to put your money where your happy is! We rarely buy things, and try to always shop for less, and that has allowed us to never miss out on what we really really want to do. 🙂