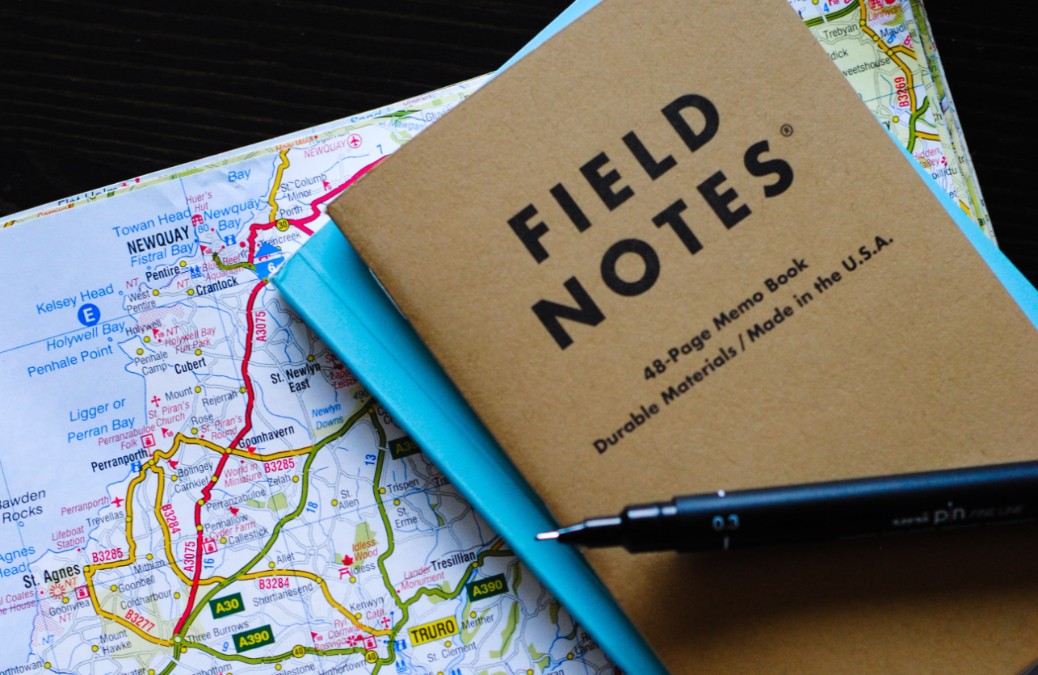

When I was 32, I celebrated one of the biggest accomplishments of my life with a plate of nachos, a vodka gimlet, and gathering of friends at my favorite neighborhood bar.

Over a plate of melted cheese, we cheers-ed my upcoming 11-month, nine-country trip. As the night wore on and more cocktails were consumed, one of my friends leaned across the table and said “Okay, I’m just gonna say what we’re all thinking. How are you paying for this?”

I laughed because of course Midwesterners have to get lightly drunk to talk about money.

After I was done laughing I spilled the beans. I told them how I managed to live sans-roommate in a nice neighborhood, pay my $375-a-month school loan, wear these cute leather riding boots, and save enough to finance this huge trip … on $34,000 a year non-profit salary.

Want to know how I did it?

(leans in close and stage whispers)

I lived within my means.

Well, that’s wildly unsexy, isn’t it? Whenever I share this not-particularly-exciting information, I can see people become a) skeptical b) disappointed. It’d be a lot more exciting if I shared a salacious investment tip or confessed that I had a trust fund or that I was just putting it all on a credit card and hoping for the best.

But that’s not what happened. I got to take my dream trip because I did things like:

-

Bring my lunch to work

-

Buy pretty much everything, ever secondhand

-

Host potluck dinner parties rather than eating out

-

Stay with friends when I traveled – or camped!

-

Split wifi with a neighbor

-

Go to matinee movies, used my library card, had picnics in the park, etc etc etc

When we talk about going after what we want, we usually talk about things like talent, luck, networking, and a tenacious work ethic. All those are important! And they will certainly help you get you closer to what you want – whatever that is.

But I’d like to posit that one of the most underrated skills necessary to chase your dreams is learning to live within your means.

What now? What does budgeting have to do with becoming an artist or a stay at home parent or opening a sanctuary for stray dogs or taking a round-the-world trip?

According to a recent survey, the average American spends an estimated $697 a month on non-essential expenses – that’s more than $8,000 a year. The mean income per capita in the U.S. is $48,150, about $24 an hour. That means the average American is working about 30 hours each month to pay for those non-essential purchases.

The average American works 360 hours a year to pay for their non-essential purchases. How much of our lives would be we get back if we made fewer of those purchases? Share on X

Now, I’m not saying we should stop making every non-essential purchase, ever. Of course not! I spend thousands of dollars every year on travel, pedicures, supper club dinners, and outfits for my dog. Dog outfit are not essential!

But it’s worth remembering that we pay for our choices with the lives that we lead and all those non-essential purchases? They lead to less money in our bank accounts > longer hours at work > less time, money, and energy for the stuff we’re really excited about.

What if you dialed in those non-essential purchases by just 10%? Totally doable, right? I bet it’d be pretty painless to wear the same outfit to multiple weddings or bring lunch to work once a week. It’s not hard to make a frozen pizza rather than having one delivered.

Reducing non-essential purchases by even just 10% could free up 36 hour this year. Imagine what you could do with that! You could practice your stand up set, launch your Etsy shop, work on your novel, or train for a marathon.

And buying less shit you don’t need might also mean you can drop the side hustle, the overtime, or the second job. Which means – I bet you can see where I’m going with this – you’d have more time and energy to pursue things that light you up.

Real talk: dreams + goals require time and energy. It’s hard to find either if you’re working 60 hours a week to support expensive spending habits. Share on X

Now, any conversation about money should acknowledge privilege. Because of the realities of life in America, some people will have to take jobs they hate because they need the healthcare coverage. Some people really do need to work 60 hours a week in order to pay for the bare necessities.

Not everyone has the time to wander the aisles of Goodwill, digging through racks of cheap secondhand clothing. Some people live in food deserts and they can’t do a huge shopping trip and then meal prep + freeze seventeen healthy, affordable meals that break down to $3 per person, per meal.

However, many of us – I’d hazard a guess most of us – could make one or two different financial decisions that would free up hundreds or thousands of dollars a year. Which would free up the time and energy we put into earning that money. And we could put that time and energy into something we’re really excited about.

If you’re really honest with yourself, where you could you rein in spending to free up money, time, and energy to spend on things you’re excited about? Tell us in the comments to create public accountability!

P.S. If you want help reducing those non-essential purchases in a way that doesn’t feel like deprivation, my incredibly popular program Bank Boost opens for enrollment on November 7th. Last time I ran it, it sold out in four days so you might want to jump on the waitlist!

Great tip! I’m very thrifty (being stingy helps lol) but I suppose I could rein in my snack budget a bit more… I always overspend on snacks!

Charmaine Ng | Architecture & Lifestyle Blog

http://charmainenyw.com